AhlulBayt News Agency (ABNA): While Turkey is hit hard by the hardest economic crisis since President Recep Tayyip Erdogan has assumed the power two decades ago, he seems to be setting his heart on help from the Persian Gulf, specifically Qatar. The Turkish national currency has now depreciated to a historic rate of 13.72 lira against the US dollar, sounding the alarm for the ruling Justice and Development Party (AKP) leaders.

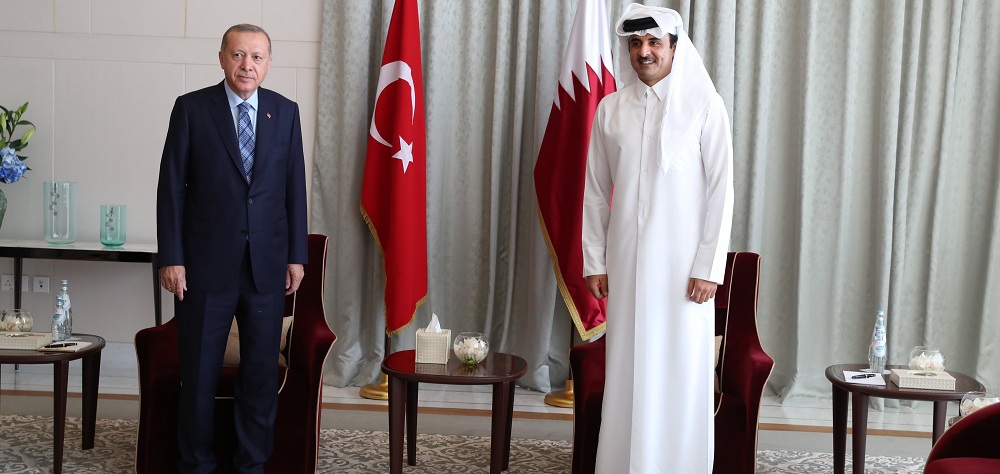

In such a situation, it seems that Erdogan has once again extended a helping hand to Qatar as a close Muslim Brotherhood-affiliated government to save himself from the great economic crisis. He traveled to Doha for a two-day visit on Tuesday to meet with Qatari leaders.

This raises a question: Can a financial support from Doha grab him out of crisis like the part years?

Historical lira slump and Erdogan's need for emergency economic surgery

In all the years since 2002, the AKP has won over large numbers of votes with astonishing economic successes. This made the economy the main tool for Erdogan and AKP's domino successes in the parliamentary and presidential elections. But now the collapse of the Turkish lira has become a major challenge for the president to stay in power. In recent weeks, a significant number of protestors have gathered around his lavish palace and called for his resignation in demonstrations grabbing the calm from his eyes.

The historic fall of the Turkish lira price afresh came after Erdogan's speech on lowering interest rates and the implementation of his orders by the central bank. On November 19, first drop took place, with each dollar, growing 6.14 percent, reaching 11.118 lira. This continued over the past few weeks, with now each dollar traded 13.9 lira.

In the midst of the crisis, the inflation rate of nearly 20 percent and the volatility in the economic decisions of the leaders of the AKP pushes Turkey further face to face with risk of foreign capital exit. In the past few years, 15-percent inflation rate made the foreign investors delay injection of capital into the Turkish economy. Meanwhile, a 19-percent interest rate had attracted foreign investors to the country, but cutting it to 15 percent seems to have led to foreign investment fleeing. All these necessitate for the Turkish economy more than ever an urgent surgery or help.

Erdogan's special hope for salvation from Persian Gulf window

Recep Tayyip Erdogan has had a considerable level of tensions with the Persian Gulf states, especially the UAE and Saudi Arabia and excluding Qatar, over the past few years, but now he seems to have stretched out his hand for help to the oil-rich monarchies for exit from economic predicament. Although his Qatar visit is grabbing more focus, Erdogan on November 24 hosted in Ankara the UAE de facto ruler Prince Mohammed bin Zayed Al Nahyan. At the time, media outlets highlighted a proposal by bin Zayed to Erdogan about $10 to $100 billion investment in the Turkish economy. With him badly stuck in an economic quagmire, the Turkish leader seems to have invited bin Zayed for this aim.

The Saudi Crown Prince Mohammed bin Salman arrived in Qatar as Erdogan is still in Qatar. Although Qatar's foreign ministry said the visits are coincidental, many agree that Erdogan and bin Salman's tours are never coincidental. All the evidence suggests that, after Qatar and the UAE, Erdogan is likely to test his last hope in the coming weeks in resolving the economic crisis by traveling to Riyadh or inviting Prince Mohammed to visit Turkey.

Qatar and Erdogan's economic swamp

Undoubtedly, as in the past few years, Qatar is the main focus of Erdogan's hopes for a way out of the economic crisis. He is well aware that the continuation of the current situation will mean his defeat in the 2023 presidential election, so he is struggling for a way out with the support of Qatar's ruling Al Thani family. In 2018, Qatar helped Turkey out of currency crisis by injecting $15 billion in its economy.

Also, over the past three years, the Qatari Emir Tamim Bin Hamad Al Thani has returned Erdogan's blockade-time favor by investing in Turkish banks, real estate, and hotel sectors, and has played an important role in rescuing him from the economic crisis.

Since the coronavirus outbreak, the Turkish hard currency reserves shrunk $17 billion, dropping to $89.2 billion, with the lira experiencing sharp crash in May and early June. In the middle of desperate need for help from Qatar, Doha and Ankara signed an agreement for increasing the level of banking and currency exchanges to $15 billion.

In his visit to Qatar, Erdogan sounds upbeat about Doha standing by Ankara as an ally and close friend while the latter is grappling with hardship caused by national currency price slump. In return, Qatari leaders expect Turkey to maintain its logistical and political help to them in the Persian Gulf crises.

/129